[ad_1]

anyaberkut/iStock via Getty Images

investment thesis

UiPath (NYSE:PATH), an industry leader in RPA, offers end-to-end automation for businesses. However, since its IPO, UiPath has dropped 47.74%. At $34.73, UiPath is an undervalued, high-growth automation leader with strong customer retention. It is perfectly positioned, amidst a supply-chain crisis and labor shortage, to deploy its software solutions. UiPath is a Strong Buy for long-term investors that are betting on automation in business workflow.

UiPath’s solution is end-to-end, it aims to identify the inefficiency, propose and build solutions, and evaluate their impact. With the scale, experience, and human capital that far exceeds their competitors, UiPath is best positioned to dominate the enterprise automation industry.

Background

Enterprise automation solutions is a rapidly growing industry. The demand to automate processes increases with technological integration in all industries. While automation was largely interpreted within the context of manufacturing – the use of equipment to automate production processes, today, automation is no longer just about replacing human labor with machine labor. As the world turned digital, the focus has shifted towards workflow automation. Businesses need to eliminate repetitive tasks to achieve operational efficiency and allow employees to focus on higher-value work.

Robotic Process Automation (RPA) companies build software robots that allow businesses to automate digital tasks. In fact, the surging labor shortage and costs is the perfect accelerator for digital automation – a cost-effective solution. Simply, RPA is the process automation technology that is integral to streamline business processes.

Company Overview

UiPath is unlike many of Silicon Valley’s high-growth start-ups causing uproar. It is built on a solid foundation, having been founded in 2005, and with over a decade of compounding experience and wealth, the automation giant has been built. UiPath is a market leader in RPA solutions, leveraging cutting-edge AI/ML capability, 35,000 developers, and more than 1.5 million members to rapidly transform business operations. UiPath allows businesses to discover, build, deploy, and manage software robots and employees to focus on high-value tasks.

Most importantly, their automation solutions can be implemented across industries, including the manufacturing, healthcare, insurance, financial services, and telecommunication sectors. Through UiPath, firms can recognize automation opportunities, build specialized automation tools, automate processes by deploying software robots, and manage their automation to optimize results. According to UiPath, “Software robots — instead of people — do repetitive and lower-value work, like logging into applications and systems, moving files and folders, extracting, copying, and inserting data, filling in forms, and completing routine analyses and report.”

Besides that, Daniel Dines’ ambition and vision for the company is noteworthy. He’s been quoted as saying, “Bill Gates used to talk at Microsoft about a computer in every home. I want a robot for every person.” It is critical to realize that ambitions for UiPath are beyond the business-to-business segment, as it already collaborates with developers. UiPath’s next business challenge remains in building itself as a household name like Microsoft.

business segments

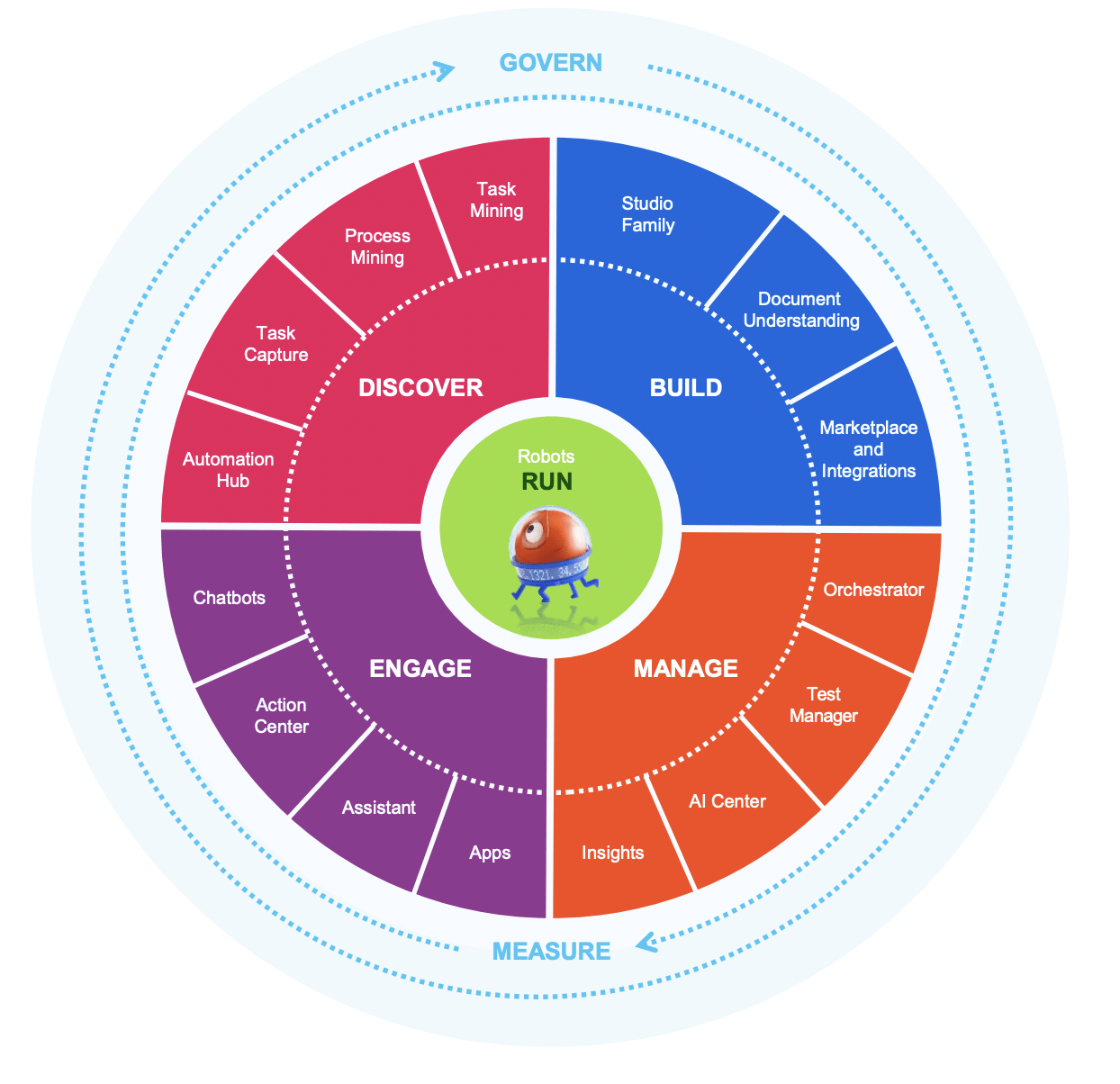

UiPath’s unique selling point is its ability to offer end-to-end solutions for it’s high-spending clients. According to UiPath Investor Presentation, the end-to-end automation system permits companies to discover possible automation areas, build the necessary platforms, manage deployments, and engage with the system. For large firms, business processes are complex and hard to streamline, though , with UiPath’s complete range of product offering, the process is smoother and more effective. Likewise, their services are segmented into Discover, Build, Manage, and Engage.

Moreover, their offering can be deployed not only in a cloud-based infrastructure, but also on-premises, or in a hybrid environment. While customers are moving to the cloud, a flexible deployment and multi-cloud strategy helps grow their ecosystem and customer base.

Investor Presentation

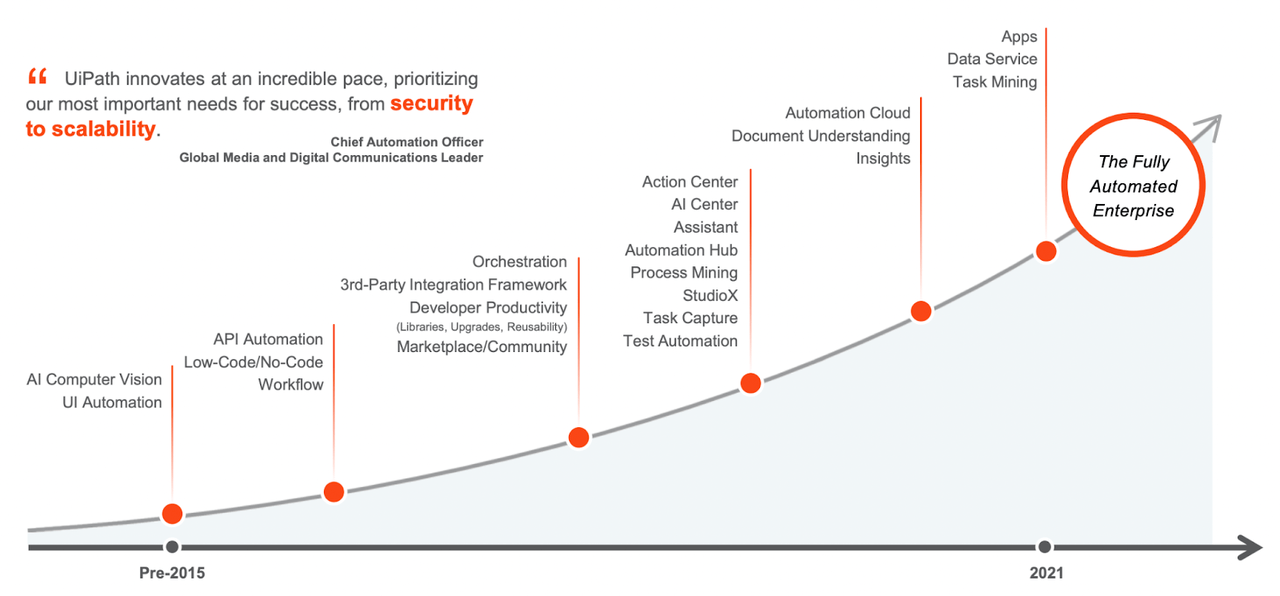

Most importantly, UiPath’s focus remains on expanding their services through innovation. As businesses get larger, they fail to innovate; however, UiPath’s rapid releases and depth of technology permit their market leadership. With that, their new product offerings include Task Mining & Process Mining.

Investor Presentation

Much like the other automation firms, it is critical to stay ahead of the curve through continuous innovation. A key metric, the Annualized Renewal Run rate, is growing at incredible rates – this is evidence that UiPath’s services are much needed. It’s long-term contracts with large clients has given UiPath access to the capital required for R&D. In Q3 ’21, it employed $61,559,000 towards R&D, up from $27,456,000 in Q3 ’20. While this has caused negative operating profits, the payoffs remain to be realized in the long run. As a high-growth firm, it is critical that a majority of the cash is devoted towards SG&A and R&D costs to employ the best human capital with access to high-quality resources.

Competition

With regards to your competitive landscape, UiPath is a well-recognized leader. Their biggest competitor is Microsoft, a technology giant that operates in “Cloud, Computers, Apps & Gaming.” That is also their biggest drawback, as they compete with a company that has decades of experience and talent dedicated to RPA and automation in the workplace. Even with the recent acquisition of Activision for a staggering $70 billion, it is evident that Microsoft aims to dominate the D2C metaverse industry. Their investments are indicative of their intention to build an immersive ecosystem, rather than an automation solution for enterprises.

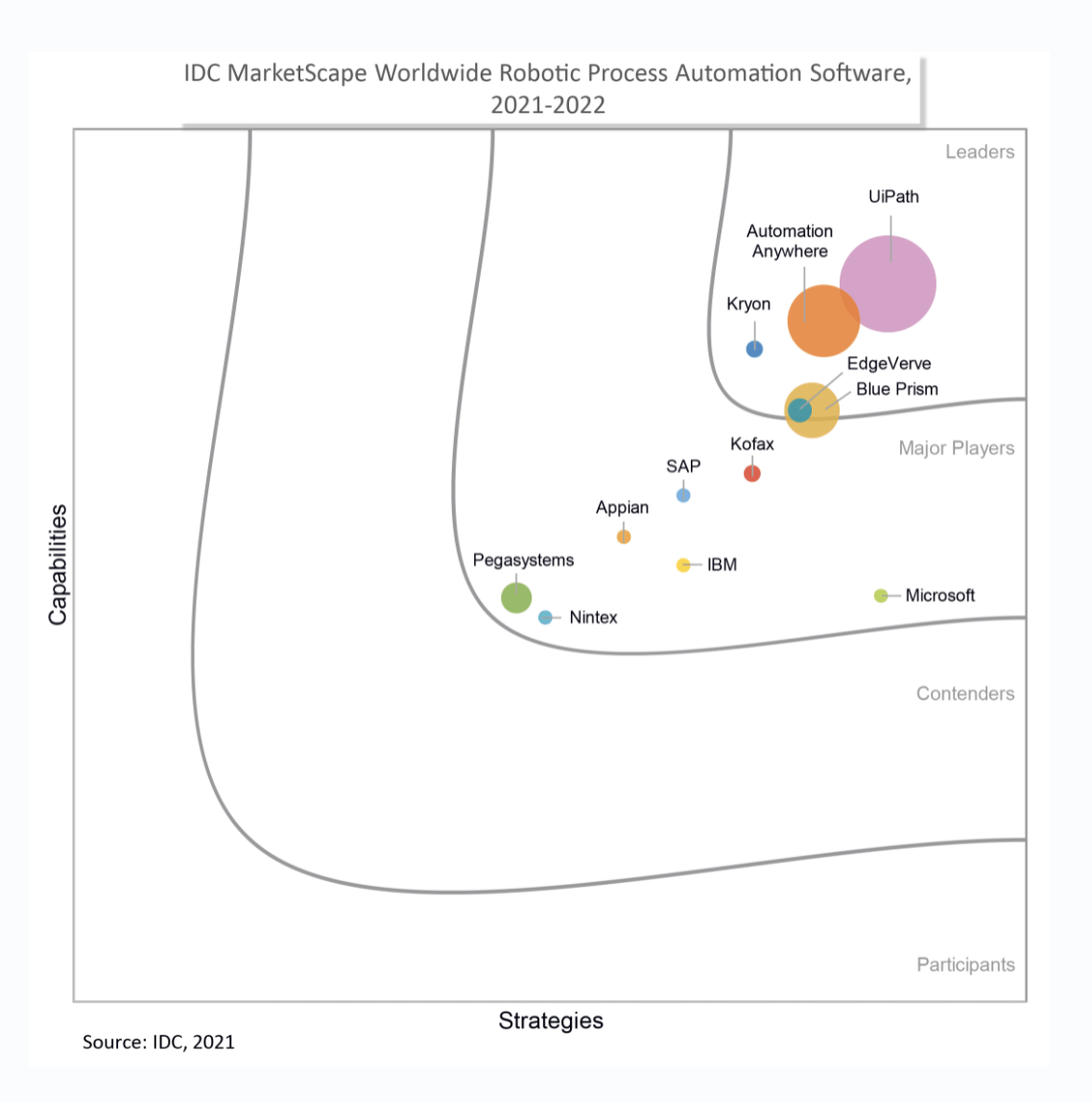

Other competitors include Automation Anywhere, Blue Prism, WorkFusion, Kofax, Pega. The 2021 Gartner Magic Quadrant revealed that UiPath dominated the market share and far exceeded the other competitors, only Automation Anywhere had similar capabilities. However, Automation Anywhere is still a private company and it is difficult to grasp their ARR and revenue generating abilities. Regardless, Microsoft and other players do not provide similar levels of RPA solutions.

Another interesting firm – Blue Prism, recently raised $130 million through a stock issue. SoftBank has also poured >$300 million into the industry with its bet on Automation Anywhere.

According to the report, “UiPath showed differentiation in multiple areas of its platform, and some of the newer features, such as the event-driven architecture of its long-running workflow capability, have the potential to disrupt the larger process automation market.”

Below is the IDC MarketScape quadrant.

site

Source: UiPath Article

valuation

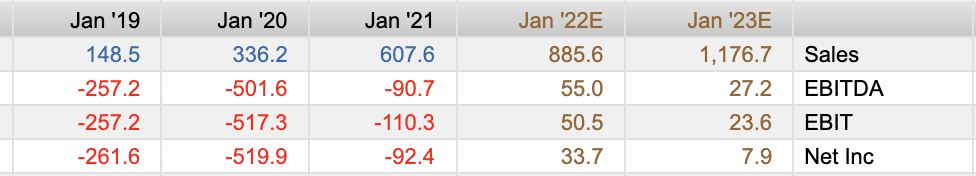

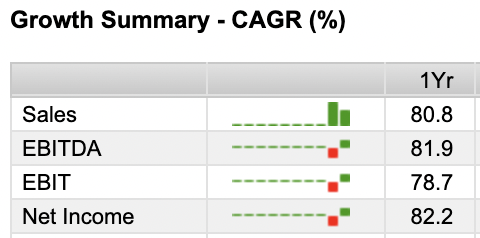

UiPath’s ability to achieve profitability has been challenged, however, the firm is about to break-even on a cash basis. They are also expected to generate positive Net Income in FY 22. Moreover, they are witnessing growth of >80% on a YoY basis.

FactSet

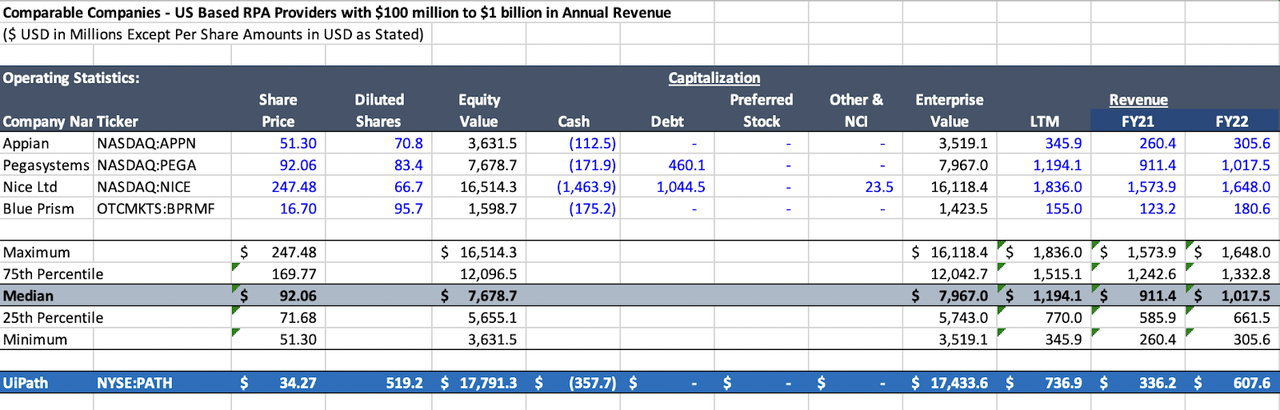

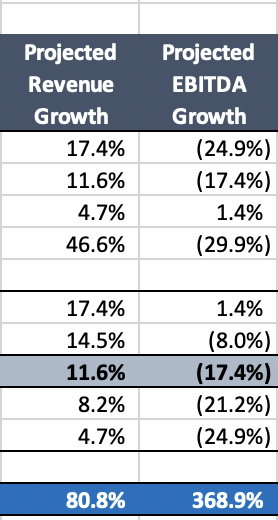

FactSet

UiPath growing at 80.8%, while industry peers growing at 11%. Likewise UiPath is looking to break even in the next 1-2 years.

Author

Author

It is impossible to time the market accurately. The revenue growth and road to profitability, however, seem to be approaching. While the business fundamentals remain strong, with a healthy balance sheet, it is critical that investors invest for the gains in the long run. For a business that has heavily invested in innovation, secured high-spending clients, and has access to human capital, the prospects look positive.

risk

Like other high-growth technology firms, UiPath is on path to achieving profitability. However, investors are concerned about the required investment time horizon. It is crucial to recognize the existing trend, as the net profit has improved from -$519.93 million to -$92.39 million from 2020 to 2021. In the same period, it has maintained an 80% in revenue from $336.16 million to $607.64 million.

Post-IPO companies can be considered risky. In the case of UiPath, however, the CEO and senior management have a long track record and industry experience. UiPath’s revenue base is diversified and substantial, in comparison to its peers. The market for hyper-automation is ever-growing, as firms across industries and nations learn that the implementation of technological processes is cost-effective.

That said, many high-growth or “pandemic stocks” have witnessed a pullback post the Fed announcements. Rising interest rates will remain an issue for businesses that are currently burning a lot of cash to generate income. UiPath is less susceptible, for it has a healthy balance sheet. Like other stocks, UiPath has been the subject of a major sell-off that has caused the shares to plummet drastically. The full impact of the rising interest rates is unclear, but one can assume large cash balances, high revenue growth, and decreased losses make the firm less vulnerable.

Conclusion

UiPath offers end-to-end automation solutions to transform workplace operations. Based on UiPath’s growth rate and undervaluation, UiPath is a Strong Buy. Still, it is critical to invest with a long-term perspective and increase capital allocation as the stock begins recovery. The sell-off in tech stocks may continue in the near future, so it is critical that investors pay close attention to valuation levels, as markets may overreact and provide more opportunities.

[ad_2]